In today’s digital world, buying online and secure e-commerce payments is as routine as that morning cup of coffee. Yet, amidst this convenience lies a crucial concern: security.

Recent studies project that cybercrime is poised to inflict a staggering $8 trillion in damages on a global scale. Amidst this digital landscape, the indispensability of secure e-commerce payments cannot be emphasized enough.

Payment gateways play a pivotal role in protecting customer trust and ensuring the safety of sensitive financial information. Ensuring the robust security of these gateways isn’t just a good idea anymore. It’s necessary for sustained success in the digital sphere.

In this blog, we’ll explore the importance of secure payment gateways as the guardians of integrity and confidentiality in digital transactions. Read on!

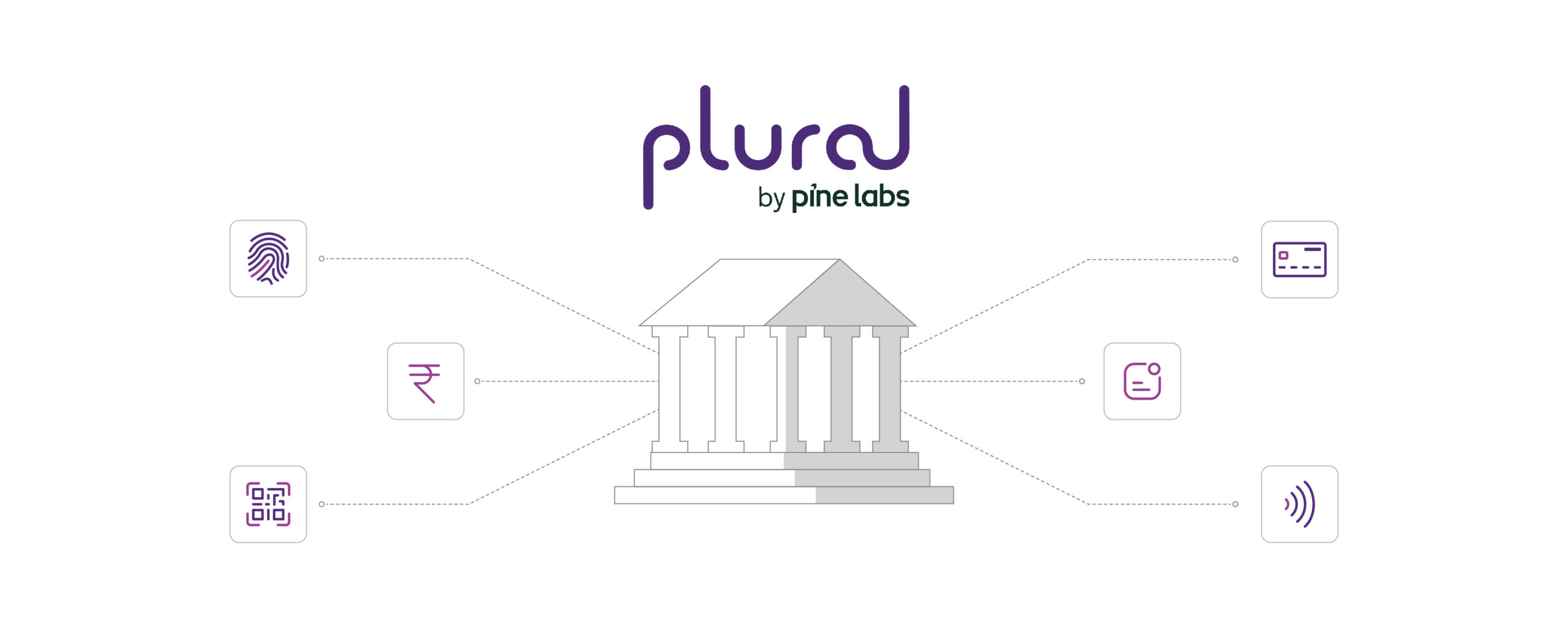

How does the payment gateway ecosystem work?

The payment gateway is the essential bridge between customers, banks, and e-commerce businesses. When a customer initiates a purchase, encrypted payment details are transmitted securely to the gateway. The gateway then verifies the data, encrypts it further, and sends it to the payment processor.

Here, the processor communicates with the customer’s bank to confirm funds availability and authenticity. If approved, the payment processor relays the confirmation back through the gateway, finalizing the transaction.

Security within this ecosystem is paramount. Encryption protocols safeguard sensitive information throughout transmission, shielding it from potential breaches. Additionally, mechanisms like tokenization replace card details with unique tokens, minimizing exposure.

However, despite robust security measures, vulnerabilities exist. Cyber threats constantly evolve, and gateways might be susceptible to breaches, risking data theft and fraudulent activities. Phishing attempts or malware can also compromise customer information if proper precautions aren’t taken.

To ensure secure e-commerce payments, businesses must prioritize strengthening the security features of their payment gateways. It fortifies their commitment to providing a safe and secure shopping experience for their valued customers.

The benefits of secure e-commerce payments

The role of a payment gateway goes beyond facilitating payments. It has also become an assurance that customers seek for the safety of their online transactions.

Here’s a look at the key benefits secure payment gateways can bring to your business:

Customer trust and confidence

Ensuring a secure payment gateway cultivates trust among customers. Surveys have shown that around 48% of cart abandonments are tied to security concerns.

By providing a secure gateway, businesses reassure customers about the safety of their sensitive data. This reassurance enhances confidence and encourages more transactions to take place.

Reduced risk of fraud

According to the Association of Certified Fraud Examiners, organizations worldwide lose approximately 5% of their revenue to fraud. These losses amount to millions of dollars each, impacting businesses significantly.

A secure payment gateway is pivotal here. It employs advanced security measures to significantly reduce unauthorized access and fraudulent activities. As a result, both the business and its customers are shielded from potential threats.

Compliance with regulations

Adherence to industry standards like PCI DSS and GDPR is crucial for e-commerce websites. A secure payment gateway ensures compliance. This not only averts potential penalties but also helps businesses maintain operational integrity.

Global accessibility

Secure gateways enable seamless cross-border operations, catering to diverse clientele without compromising security. With global retail e-commerce sales projected to reach $8.1 trillion by 2026, this accessibility is pivotal for business growth.

Improved business reputation

A secure payment process positively impacts the brand’s reputation, earning credibility and positive word-of-mouth. Studies reveal that 84% of consumers would consider leaving a vendor that did not manage their digital trust. This highlights the importance of a secure payment gateway in maintaining and improving business reputation.

Security features should you look for in a payment gateway

We’ve seen how crucial a secure payment gateway is. But how do you pick the right one? What security measures build trust with your customers? Let’s explore the key security features of your payment gateway.

Encryption standards

Ensure the gateway uses industry-standard encryption protocols like SSL/TLS to encode all transmitted data. This encryption makes your information unreadable to unauthorized parties, keeping it secure.

PCI DSS compliance

Check your payment gateway for compliance with the Payment Card Industry Data Security Standard (PCI DSS). A compliant gateway means stringent security measures in handling and storing cardholder data. This slashes the risk of breaches significantly.

Tokenization and data protection

Search for tokenization features like Plural Tokeniser. They replace sensitive data with unique tokens. Tokenisation transforms your information into codes or placeholders. This way, your stored data becomes unrecognizable to unauthorized users. It’s like having secret keys that protect your stored information, reducing the risk of data theft.

Advanced fraud prevention

Opt for a gateway armed with cutting-edge fraud detection tools, including machine learning algorithms and real-time monitoring systems. These powerful tools act as vigilant guards, continuously scanning for any suspicious activity. They swiftly pinpoint and halt potentially fraudulent transactions, significantly reducing the risk of any fraudulent activities slipping through the cracks.

Two-factor authentication

Give preference to gateways that embrace two-factor authentication. This extra layer of security demands more than just a password—it requires a second form of verification, like a code sent to a phone to ensure secure e-commerce payments.

This double-check system strengthens access control, ensuring only authorized users gain entry. It’s like having an extra lock on the door, making it significantly harder for unauthorized access to occur.

Secure APIs

Select gateways equipped with secure Application Programming Interfaces (APIs). These APIs act as secure pathways for data exchange between systems, ensuring information travels in an encrypted and protected manner.

By opting for these secure APIs, you fortify your gateway against potential threats and significantly reduce vulnerabilities.

User access control

Look out for gateways offering precise user access control. This feature acts like a digital gatekeeper, granting access solely to authorized personnel. This ensures that your business’s vital operations remain secure and inaccessible to unauthorized parties.

Support response to security incidents

In case of security incidents, ensure your gateway offers a responsive support system. Swift responses to potential threats act as a firewall, swiftly containing and neutralizing risks before they escalate. This proactive stance ensures your business stays resilient, swiftly tackling any security concerns that may arise.

Finding a gateway equipped with all essential security features is now possible with Plural. We stand out prominently due to our stringent security measures, particularly our EMVCo 3DS 2.0 compliance. This means stronger authentication, elevated security, and faster checkout experiences for your customers.

What truly sets us apart is our commitment to ensuring secure e-commerce payments, along with optimizing the checkout experience. With us, you’ll find expedited transactions, where security seamlessly blends with customer convenience.

Closing thoughts

Secure payment gateways are crucial in today’s digital landscape. Prioritizing features like robust encryption, compliance, and fraud prevention is a necessity. At Plural, we understand the significance of fortifying these gateways to ensure trust and security in every transaction.

When exploring secure gateways, consider our Affordability Suite. We offer a spectrum of payment options—card payments, No/low-cost EMIs, and cardless EMIs—prioritizing top-notch security. Each transaction undergoes stringent security measures, guaranteeing seamless and secure e-commerce payments for your customers.

Looking for more ways to improve your e-commerce business? From tips to preparing for the festive season to innovating pricing strategies, explore our exclusive list of articles here.

Integrate Plural’s Affordability Suite for secure and convenient transactions that prioritize your customers’ safety! Contact us today!

Experienced marketing professional specialising in setting up and executing go-to market strategies to improve leads, increase brand awareness, optimise funnel and maximise revenue of a business.