As the Finance Minister, Nirmala Sitaram announced the budget for 2023 on February 1st, there were noteworthy mentions for digital payments, businesses and emphasis on digital infrastructure.

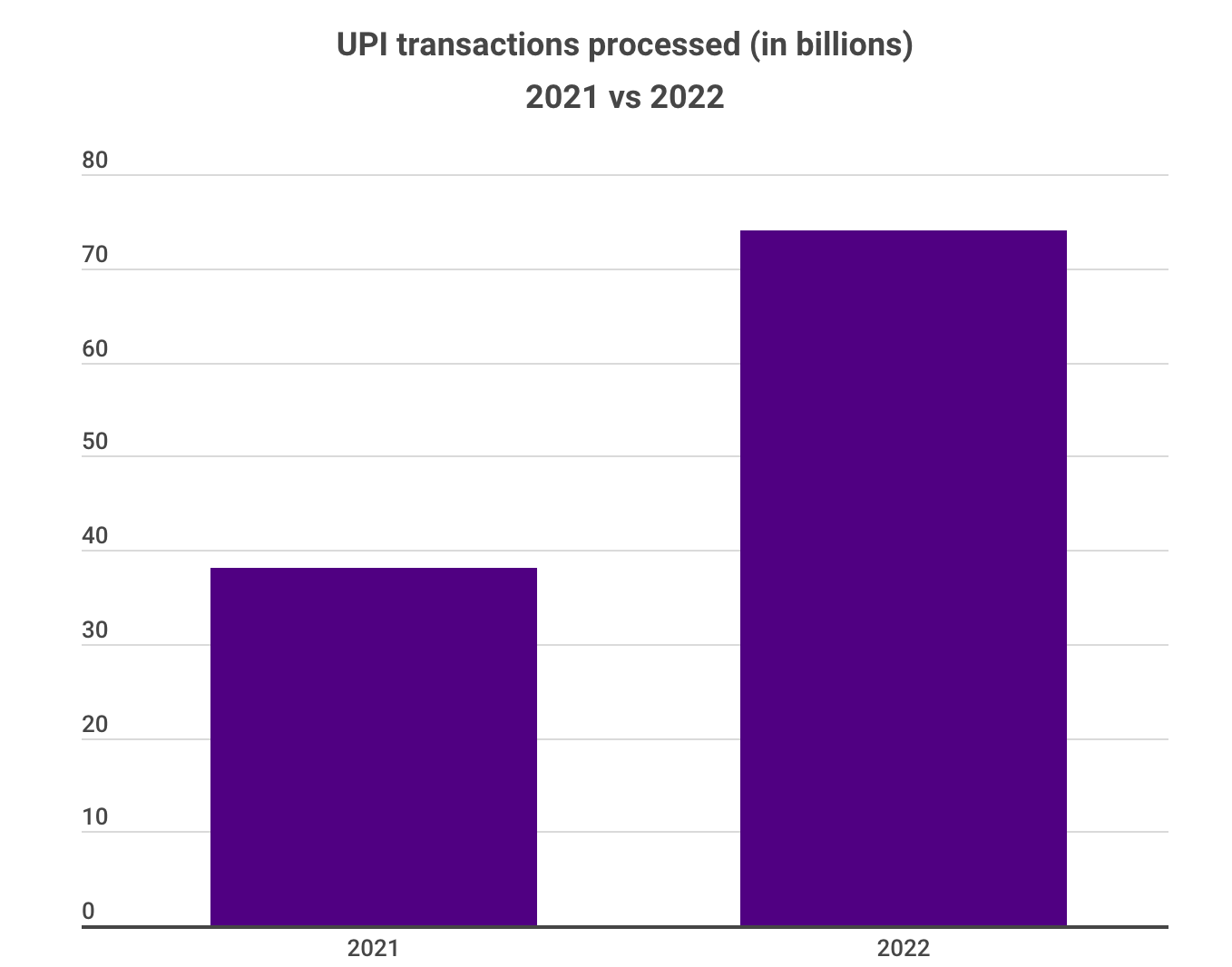

Reflecting on the achievements of digital payments, Niramala Sitaram mentioned that the Indian economy has clocked in 74 billion digital payments worth Rs. 126 lakh crore through UPI in 2022.

Additionally, the Finance Minister said, “Fiscal support for this digital public infrastructure will continue in 2023–24.”

Here is our quick take on the budget in 30 secs.

https://cdn.embedly.com/widgets/media.html?src=https%3A%2F%2Fwww.youtube.com%2Fembed%2Fvqe8m4MuQQ4%3Ffeature%3Doembed&display_name=YouTube&url=https%3A%2F%2Fwww.youtube.com%2Fwatch%3Fv%3Dvqe8m4MuQQ4&image=https%3A%2F%2Fi.ytimg.com%2Fvi%2Fvqe8m4MuQQ4%2Fhqdefault.jpg&key=a19fcc184b9711e1b4764040d3dc5c07&type=text%2Fhtml&schema=youtube

Let’s look at the highlights for businesses, digital systems and Artificial Intelligence (AI).

Improvements for businesses

- Credit guarantee for MSMEs from April 1, 2023 with Rs. 9,000 crore in corpus

- This will also enable additional collateral-free guaranteed credit for Rs. 2 lakh crore and reduced cost of credit by ~1%

- MSMEs unable to execute contracts during COVID to get a 95% return of the forfeited amount related to bid or security by government and government undertakings

- Permanent Account Number (PAN) to be a common identifier for all digital systems of specified government agencies

- Over 39,000 compliances have been reduced and 3,400+ legal provisions have been decriminalised to enhance ease of doing business

Improvements in AI and digital services

- One stop solution for reconciliation and updating identity maintained by various agencies to be established using DigiLocker and Aadhaar as foundational identity

- Scope of services in DigiLocker to be expanded

- Push to make the know-you-customer (KYC) ecosystem more ‘amenable’ to digitisation

- The KYC process to be simplified by adopting a ‘risk based’ approach instead of a ‘one size fits all’ approach

- 100 labs for developing applications to use 5G services to be set up in engineering institutions

- 3 centres of excellence for artificial intelligence to be set up in top educational institutions

What this means for businesses and the digital ecosystem

Wrapping up

Investments in AI and 5G and the promise of continued fiscal support for the digital public infrastructure will be the backbone of innovation and development.

Overall, the budget is a big boost to businesses and entrepreneurs. The acknowledgement of the growth of digital payments and the fiscal support for digital infrastructure are wins for us in the payments business.

Looking for payment solutions for your business? We’ve got you covered.

Reach us at pgsupport@pinelabs.com.

Plural by Pine Labs has received an in-principle authorisation from the Reserve Bank of India (RBI) to operate as a Payment Aggregator.

This article has been written by Amrita Konaiagari (Marketing Manager at Plural by Pine Labs).

Amrita Konaiagari is a Marketing Manager at Plural by Pine Labs and Editor of the Plural blog. She has over 10 years of marketing experience across Media & Tech industries and holds a Master’s degree in Communication and Journalism. She has a passion for home décor and is most definitely a dog person.